Sync New ATX Contacts with CCH iFirm

When you create a new tax return in ATX, if the contact does not yet exist in CCH iFirm, ATX allows you to sync the contact information to CCH iFirm.

ATX requires an SSN or EIN to sync with CCH iFirm’s contact database. If you create contacts in CCH iFirm, be sure to enter the SSN or EIN before importing into ATX. If you create an ATX return for a CCH iFirm contact that does not have an assigned SSN or EIN, the system assumes that this is a "new contact" and a duplicate contact is created in CCH iFirm.

To sync new ATX contact information to CCH iFirm:

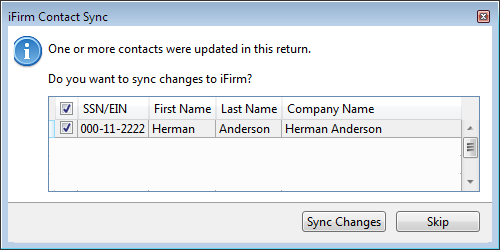

- When you close the new return in ATX the iFirm Contact Sync dialog displays.

iFirm Contact Sync dialog

- Select the contact(s) you want to sync to iFirm. Click Sync Changes. ATX exports your client's contact information to CCH iFirm. See Sync Contact Data on Open and Close for information what type of data is shared with CCH iFirm.

If you choose to Skip, you will not be prompted to sync again unless you have edited the information in the return.

Viewing Contact Data in CCH iFirm

If you're in ATX but you want to view contact data in CCH iFirm:

- Click the CCH iFirm button and login to CCH iFirm.

- Select Contacts; then, select All Contacts.

- In the Search field, enter the contact name and press Enter.

See Also:

Import CCH iFirm Contact Data into a New Return